Lames et anneaux Hack Cheats - Diamants illimités et Or 2020

Lames et anneaux Hack Cheats - Diamants illimités et Or 2020

Lames et anneaux Hack Cheats - Diamants illimités et Or 2020

Blade and Wings: Fantasy 3D Hack / Cheats 2020 - Le moyen le plus simple d'obtenir des gemmes gratuites! (iOS / Android)

ù Ã   €  Â                                                                                                                            Lâches Lames et Bagues Hack Gold and Diamonds  € ™ sâ € ™ â € ™ â € ™ â¹â € ™ â € ™ â¹â € ™ â¹â € ™ â¹Â                       †                                                                                                                                                                     Â.   Â                                                                                                                                                       Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  Â  ¥ å à aA-à ¹Œà à aA ¸²à à aA aA • à ¸Â'à aA » à aA • à ¸²à ¸¡à  ¸ ”¹ ‰் šà ¸š

2 joueurs en ligne Répétez le patron d’essais autant de fois que vous le souhaitez. Fermez 105 niveaux si vous voulez des résultats rapides.

Lames et anneaux Hack Cheats - Diamants illimités et Or 2020

Lames et anneaux Hack Cheats - Diamants illimités et Or 2020

Salut les gars,

Voici comment j'ai obtenu mon or et mes diamants gratuits!

Je suis comme vous qui essayez de trouver des outils de travail pour obtenir de l'or et des diamants gratuits ! Aujourd'hui, je vais vous montrer que vous travaillez sur l'un de ceux que j'ai trouvés. Je vais vous montrer toutes les étapes de cette vidéo, alors suivez-la attentivement. Vous pouvez ajouter jusqu'à 999 999 Or et Diamants à la fois. J'ai essayé cela avec tous les appareils Android / iOS / PC / MAC et ils fonctionnent tous.

Profitez de vos gars gratuits Gold et Diamonds, je veux simplement partager cela avec vous car je connais le sentiment d'essayer différents les outils et ils se sont tous avérés ne fonctionnant pas.

Je continuerai à rechercher d'autres outils de travail et à faire des vidéos si j'en trouve, cette chaîne sera dédiée à nous, les personnes qui n'ont pas assez d'argent pour acheter. Des trucs pour ces jeux pour gagner des jeux!

S'il vous plaît, aimez la vidéo si elle fonctionnait pour vous!

J'espère que vous avez apprécié cette vidéo, commentez, aimez et inscrivez-vous pour plus de vidéos!

iOS: https: / /itunes.apple.com/app/blades-and-rings/id1173742948?mt=8

Google Play: play.google.com/store/apps/details?id=com.games37.yhjy&hl= en

Facebook officiel: www.facebook.com/BNR.37Games/

Lames et Anneaux Hack Cheats 2020 - Obtenez 10000 Diamants

Lames Et Anneaux Hack - Lames Et Anneaux Apk Mod

Lames et bagues Hack - Lames et bagues Hack Diamonds en quelques minutes 2020 (Android et iOS)

Bonjour à tous! Dans ce didacticiel vidéo, vous apprendrez à pirater Blade et Wings: Fantasy 3D et à obtenir des milliers de gemmes gratuites que vous pourrez utiliser à votre guise et qui permettront d’améliorer considérablement votre progression dans le jeu. Le processus de piratage est vraiment facile, cela prend environ 5 minutes, mais une fois que vous le faites, vous serez très satisfait des résultats. Peut-être que la meilleure partie de ce jeu Blade and Wings: Fantasy 3D réside dans le fait que vous pouvez répéter le processus encore et encore, ce qui signifie que vous ne pouvez pratiquement jamais manquer de pierres précieuses. Si vous avez des questions sur cette astuce Blade and Wings: Fantasy 3D, n'hésitez pas à les écrire dans la section commentaires, et nous vous répondrons dans les meilleurs délais. Aussi, abonnez-vous à notre chaîne pour plus de choses comme ça. Merci de nous regarder, Gameland.

Music:

Parler avec vous de Artificial.Music soundcloud.com/artificial-music - Creative Commons ™ Attribution 3.0 Unportedâ € ™ CC BY 3.0

http: //creativecommons.org/licenses/b ...

Musique promue par la bibliothèque audio youtu.be/NAgcAg0pW6w

Blades and Rings Hack ™: Cheats for Diamonds and Gold UNLIMITED

Lames et Anneaux Hack Cheats - Diamants illimités et Or 2020

Lames et anneaux Hack, Lames et Anneaux cheats anneaux pirater ios, lames et anneaux bidouiller android, lames et anneaux comment obtenir des ailes, lames et anneaux piratage, lames et anneaux hack 2020, pirater lames et anneaux, générateur de lames et anneaux, lames et anneaux , lames et anneaux piratent mod, lames et anneaux ne piratent aucune vérification, lames et anneaux piratent apk, lames et anneaux meilleure classe, jeu de lames et anneaux pour pc, Lames et anneaux

Codes Cheat Lames Et Bagues - Lames Et Bagues Apkpure

Lames Et Bagues Hack - Lames Et Bagues Personnages

www.playground.ru

asphalt xtreme Hack Unlimited Credits (Android / IOS)

asphalt xtreme Hack Unlimited Credits (Android / IOS)

asphalt xtreme Hack Unlimited Credits (Android / IOS)

Commencez ici: www.findreviews.org/asphaltxtremeasphalt xtreme Outil de triche:

Générer jusqu'à 999 000 crédits par demande

Générer Jusqu'à 500 000 crédits par demande

À recevoir instantanément après vérification

à Compatibilité avec les plates-formes iOS et Android

Fonctionnalités:

à fonctionne parfaitement sur n'importe quel ordinateur de bureau ou mobile / Navigateurs de smartphones

100

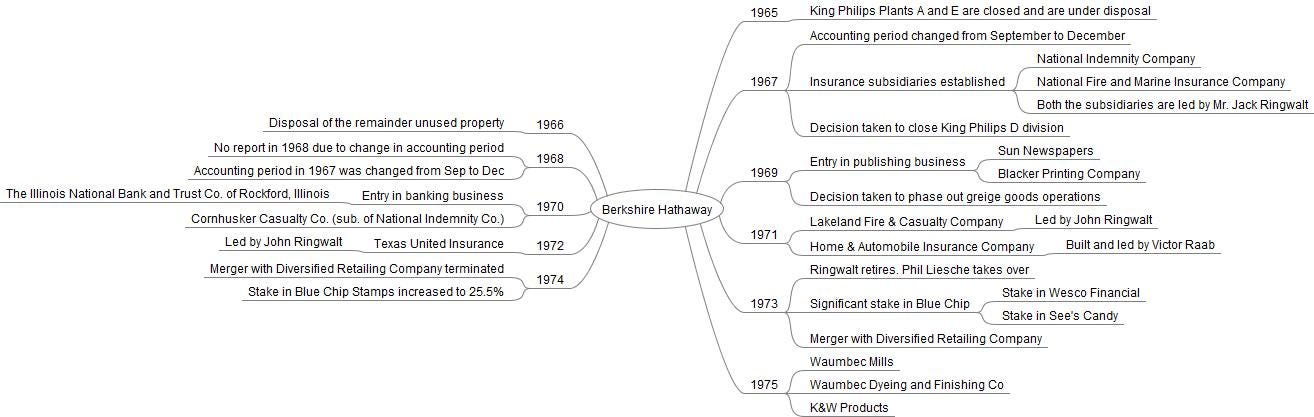

1975: Lessons from letters to shareholders of Berkshire Hathaway

1975: Lessons from letters to shareholders of Berkshire Hathaway

With this lesson, we are on to the 11th letter written by Warren Buffet to the shareholders of Berkshire Hathaway.

Letters prior to 1977 are not available for download and hence I am unable to exactly reproduce the relevant sections of the report for the takeaways. For ease, wherever necessary, I have summarized the relevant text from the annual reports.

Readers are recommended to purchase a copy of the letters. You can get it by clicking here or here.

Now, we begin with this year’s lessons.

“Last year, when discussing the prospects for 1975, we stated “the outlook for 1975 is not encouraging.” This forecast proved to be distressingly accurate…producing a return on beginning shareholder’s equity of 7.6%. This is the lowest return on equity since 1967. Furthermore, as explained later in this letter, a large segment of these earnings resulted from Federal income tax refunds which will not be available to assist performance in 1976.”

Takeaways

This is the first paragraph of 1976’s letter. As usual, Buffett gives away the bad news without any trace of efforts to soften the results. As if the bad results were not enough, he even draws attention to the higher profits that resulted due to tax shield from the losses incurred last year. This kind of disclosure separates high quality management vs one’s that are average/low.

Textile Operations

Textile operations have been discussed in detail after quite a long time. Also, an acquisition (Waumbec) was made and Buffett lays out his view on capital expenditure for textile operations.

“We acquired Waumbec Mills Incorporated and Waumbec Dyeing and Finishing Co., Inc…Such drapery materials complement and extend the line already marketed through the Home Fabrics Division of Berkshire Hathaway. In the period prior to our acquisition, the company has run at a very substantial loss…Outstanding efforts by our manufacturing, administrative and sales people…have moved Waumbec into a significant profit position.”

Takeaways

Rationale for the acquisition is well explained. Unlike most cases, note the absence of the words like synergy, transformation etc. It usually means that the management is overpaying for the acquisition. It is also disclosed that the Waumbec was incurring operational losses before the acquisition and this scenario changed later. We can deduce that Waumbec was not overpaid for its acquisition and that Ken Chace (running the textile operations at Berkshire) is an excellent manager. For Ken Chace, Buffett says:

“We have great confidence in the ability of Ken Chace and his team to maximize our strengths in textiles. Therefore, we continue to look for ways to increase further our scale of operations while avoiding major capital investment in fixed assets which we consider unwise, considering the relatively low returns historically earned on large scale investment in new textile equipment.”

Takeaways

This explains why Berkshire didn’t expand in textile operations. The competitiveness and the cyclicality of the industry made it an unattractive area to invest money in. At the same time, the textile operations have not been ignored. The continued capital investment (though small in amount) is attributed to the belief in Ken Chace’s ability to run the operations. Ken Chace must have been a terrific manager.

Insurance Underwriting

Buffett begins with these words:

“The property and casualty insurance industry had its worst year in history during 1975. We did our share-unfortunately even somewhat more. Really disastrous results were concentrated in auto and long-tail (contracts where settlement of loss usually occurs long after the loss event) lines.”

He then explains the factors which caused widespread loss in the insurance industry. He attributes the loss to:

- Economic inflation — increase in cost of repairing humans and property outstripping the general rate of inflation

- Social Inflation — expansion of liability concepts far beyond limits contemplated when rates were established

He adds:

“Berkshire Hathaway’s insurance subsidiaries have a disproportionate concentration of business in precisely the lines which produced the worst underwriting results in 1975…our “mix” has been very disadvantageous during the past two years and it well may be that we will remain positioned in the more difficult part of the insurance spectrum during the inflationary years ahead.”

Takeaways

Buffett explains the losses of the insurance industry and that of Berkshire’s insurance business in great detail. By letting the cat out of the bag, Buffett sets the tone of the letter. He lets the shareholders know that nothing is being hidden.

He later talks about the Insurance division in Texas. In earlier letters (1975 and 1974), it was disclosed that this division was having problems and that the management is looking into it. In this letter Buffet says:

“Texas United Insurance Company…has made outstanding progress since George Billing has assumed command…Texas United was the winner of the “Chariman’s Cup” for achievement of the lowest loss ratio among the home state companies.”

Buffett not only praises Billing but also makes sure to follow-up on the update of Texas Insurance which was first discussed in 1975. The emphasis is on the word follow-up. We say, do and promise many things in our daily life but most of us rarely take the time to follow-up how things have been. This is what sets Buffett apart.

He ends the insurance section by saying:

“Overall, our insurance operation will produce a substantial gain in premium volume during 1976. Much of this will reflect increased rates rather than more policies…Underwriting experience should improve — and we expect to — but our confidence level is not high. While our efforts will be devoted to obtaining a combined ratio below 100, it is unlikely to be attained during 1976.”

Buffett began by openly discussing the severe losses of the insurance industry and insurance divisions of Berkshire’s. He ends by saying that while gains in volume will be made; profitability might not be achieved in 1976. If this happens, it would mean three years of struggle (1974–1976). It is a hard statement to make and a difficult one to digest by the shareholders. Nevertheless, Buffett said it. He doesn’t want to mislead the shareholders in any way.

Insurance Investments

“Our equity investments are heavily concentrated in a few companies which are selected based on favorable economic characteristics, competent and honest management, and a purchase price attractive when measured against the yardstick of value to a private owner.”

Takeaways

Buffett gives away the criteria’s he uses for investments. His emphasis on economics, competency and management makes sense and are similar to qualities that Berkshire has. Lastly, he has a limit of price when purchasing an investment. Inversely, he is not willing to overpay. He would rather walk away instead of overpaying for a business. Also note that the limitation on price is not the first criteria but the last.

Banking

“It is difficult to find adjectives to describe the performance of Eugene Abegg, Chief Executive of Illinois National Bank and Trust of Rockford, Illinois, our banking subsidiary.”

Takeaway

Work like Eugene Abegg.

Acquisition of K & W Products

“Although relatively small, with sales of a little over $2 million, it consistently has generated favorable earnings. Positioned as we now are with respect to income taxes, the addition of a solid source of taxable income is particularly welcome.”

Takeaway

Just like Waumbec’s acquisition, the rationale is clearly explained and there is no mention of words like synergy, transformation etc. These are indications that the management did not overpay and of greater possibility of successful integration into Berkshire.

General Review

“Your present management assumed responsibility…in May, 1965. At the end of prior fiscal year (September, 1964) the net worth of the Company was $22.1 million, and 1,137,778 common shares were outstanding, with a resulting book value of $19.46 per share…Since 1964, net worth has been built to $92.9 million, or 94.92 per share…reduced the number of outstanding shares…to 979,569. Overall, equity per share has compounded at an annual rate of slightly over 15%.”

“Our objective is conservatively financed and highly liquid business — possessing extra margins of balance sheet strength consistent with the fiduciary obligations inherent in the banking and insurance industries — which will produce a long term rate of return on equity capital exceeding that of American industry as a whole.”

Takeaways

The quantitative metrics of Berkshire speak of the superb management quality at Berkshire. So, if we come across numbers of these kinds and while doing further reading about the management, we come across examples that we have seen so far, be assured that the company is worth making an investment in. But don’t forget about the last principle that Buffett mentioned about his equity investments — price. Don’t overpay.

Lastly, here is how Berkshire looked on paper in 1975.